Financial controller: meaning and responsibilities

A financial controller is a key employee who holds the responsibility of a company's financial statements. As the financial reporting landscape evolves, the duties of a financial controller are evolving with it.

The role of a financial controller is often misconstrued as being the same as the Chief Financial Officer (CFO). Given that both words have the word finance, that's not a shocker. However, both roles have a very different role to play in an organization.

This article will walk you through everything you need to know about financial controllership and the associated duties. We'll also talk about how the role differs from that of a CFO. Enjoy.

What is a financial controller?

A financial controller, often referred to as a comptroller, is a senior-level role within a company's accounting function. They ensure the accuracy of the financial information that goes into the company's financial statements and its compliance with the relevant accounting standards and legislation.

Financial controllers typically begin their careers in public accounting as Certified Public Accountants (CPAs). Most have at least one or more professional certifications (such as the CPA or CMA) or an MBA, and a few years of experience in a corporate setting.

Financial Controllers can also make valuable contributions to other functions of your company like corporate governance and strategic planning.

However, FC’s are generally not involved in making journal entries for day-to-day bookkeeping. Journal entries may be assigned to a junior accountant with at least a bachelor's degree. This leaves us with the question: what exactly does a financial controller do?

What does a financial controller do?

A financial controller ensures that the company's financial reports—including the financial statements—are prepared on time. They also ensure the accounting department carries out all accounting processes, from reconciling inventory to vouching while following its internal controls.

Speaking of internal controls, the financial controller also contributes to formulating a company's internal control policies.

A financial controller is typically responsible for budgeting and forecasting financial data. They are also the principal point of contact with the company's external auditors and provide auditors with any additional information they may require in the auditing process.

In essence, a controller is a chief accounting officer, which is an executive-level position. The controller, for the most part, monitors the functioning of the accounting operations of a company, and the staff of the accounting department.

Here's a summary of what you can expect to find in a controller role or financial controller job description:

- Supervise and control the company's accounting processes and operations, including: invoicing, cost accounting, inventory records, and more.

- Preparation, consolidation, and publishing of month-end financial statements (cash flow, income statement, and balance sheet.)

- Confirming the accuracy of transactions and their adherence to relevant accounting standards such as GAAP or IFRS.

- Ensuring compliance with corporate and tax laws for the relevant jurisdiction.

- Overseeing and directing financial planning and budgeting for upcoming accounting periods, and preparation of performance reports with relevant performance metrics such as variances for the previous accounting period.

- Documenting and contributing towards developing the company's internal control policies.

- Monitoring and making recommendations for the company's accounting system.

- Monitoring cash flow and age of accounts receivable and accounts payable.

- Liaising with the company's external auditors through the auditing process.

- Providing insights to the finance team and working with other leaders to formulate the company's financial strategy.

- Facilitate decision-making by providing relevant information to the CFO and providing assistance for presenting the financial reports to internal and external stakeholders.

The controller's role is one of the most critical roles in an organization. They must have strong leadership qualities, stellar communication skills, and an excellent eye for detail so the CFO can focus on the more strategic aspects of financial management.

Even though similar in connotation, the roles of a financial controller and a CFO are quite different. Let's talk about how.

Controller vs. CFO

The notion that the corporate controller and the CFO are the same is mostly, though not always, false. On some occasions, controllership does involve CFO-like functions, especially in a small business that doesn't need a CFO's expertise quite yet.

That said, CFOs are instrumental in a corporate setting and have a very different set of responsibilities and objectives than a controller within a more developed organization.

The core difference between the two functions is that a controller's job is (for the most part) about the past and present transactions of the company. The CFOs role is mostly about the company's future.

The controller is mostly concerned with the accounting function, which involves recording transactions and preparing financial statements.

The CFO focuses on preparing a financial roadmap for the company, such as deciding the viability of a merger, achieving an optimum cost of capital, and improving the overall health of the company's balance sheet.

The controller is an accounting professional who leads the accounting department, while the CFO is a financial analyst whose role is much broader. The CFO is not involved in preparing the company's books or keeping an eye on payroll taxes like the controller.

Strategic CFO rightly points out the difference between a financial controller and a Chief Financial Officer.

"The difference between a controller vs. CFO is primarily one of perspective. A controller focuses on compliance and historical record-keeping or, in other words, tactics; while a CFO focuses on planning and future performance (i.e.: strategy).

Although controllers typically come from an accounting background, the same cannot be said for CFOs. Because of the automation of the accounting process more and more, CFO’s are coming from a financial or banking background."

How to excel as a financial controller?

Now you now know how a controller is different from a CFO and what a controller's role includes. However, just knowing the responsibilities of a controller doesn't get your business anywhere unless you learn how they can excel in their work.

Let's talk about a few essentials for succeeding as a controller.

Practice accounting experience

Given that a controller will need to manage the entire accounting function of the company, they'll ideally need ten or more years of experience in a senior accounting role to succeed. These specific experience requirements, though, may be subject to the organization's size.

The controller doesn't maintain the books or crunch numbers, but they'll certainly need to know everything from basic journal entries to the consolidation of financial statements. They’ll need to talk the talk, even if they’re not necessarily walking the walk.

Provide insightful financial reporting

Financial reporting is at the center of a controller's job. Financial information is important for companies to be able to assess how their strategies performed in the past and what their future financial strategies should look like.

This means a controller's responsibility isn't limited to just accurate financial reporting. What's also important is for the financial information to provide valuable insights that can facilitate decision-making related to business administration and financial strategy.

A report (The changing role of the financial controller) by EY states a few best practices that controllers should consider while reporting financial data:

- Delivering financial data electronically

- Keeping the report brief and relevant

- Incorporating qualitative KPIs in financial reports

- Adding interpretation or comments based on experience and insight where it can provide value

Automate and optimize processes

Since the controller's job is to... well, control, they also need to control the resources utilized by the accounting function. This requires streamlining accounting processes and contributing to the company's overall efficiency.

In a controller's pursuit of process optimization, accounting automation can play a pivotal role. Automation brings efficiency and allows them to spend time on other tasks that can't be automated.

A large portion of accounting requires manually inputting financial data. Not only is this process prone to human error, but it also takes a lot more time for your team to accomplish, especially when the data is being input multiple times and in multiple places.

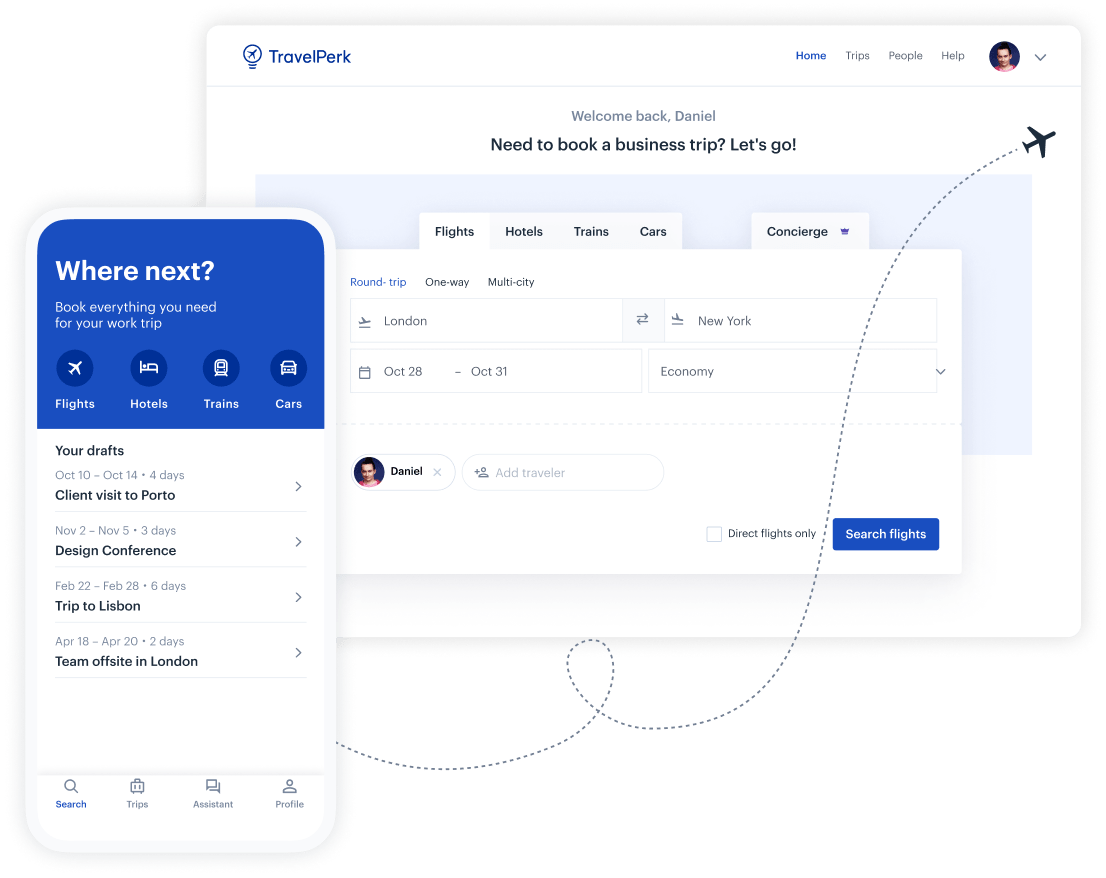

Automation can eliminate the need to manually input financial data and minimizes the risk of human error. The most common tool at a company's disposal is an Enterprise Resource Planning (ERP) program. However, several other tools can feature in a controller's automation arsenal such as an invoicing program, payroll system, and managed travel programs.

The future of controllership

A report by IMA and Deloitte (Stepping Outside the Box: Elevating the Role of the Controller) highlights that there are four broad functions that a controller performs. It adds that a large number of controllers have been focused, for the most part, on:

- managing risk

- preserving assets

- maintaining the efficiency and effectiveness of accounting operations

However, controllers can also contribute to the company’s financial strategy and drive its execution. These aspects have traditionally been a very small portion of a controller's role and are reserved for FP&A executives.

The future may be more inclusive, however, for financial controllers. Controllers can valuably contribute to a company's strategic planning. They’re the ones with the most granular data on the company's transactions and can lead the way with their ear to the ground.

If a CFO broadens their financial controller’s scope, they can unlock exponential value from a key role that has traditionally been limited only to control.