Top 7 expense tracking apps for small businesses

Expense tracking for small businesses can be tricky.

Employers want to access up-to-date, financial records without the headache of going through piles of crumpled receipts or email chains. Employees want to report expenses quickly and get reimbursed on time. Expense tracking apps help both sides of the coin.

Small business expense tracking apps help businesses to track employee spending when away on business travel and streamline the entire expense management process. These apps enable business owners and finance managers to track and manage expenses continuously for an accurate overview of business health.

Whether you’re a small business owner, running a 500+ corporate business or fall somewhere in between, this article will help you identify and evaluate the best small business expense tracking apps for you. We’ll look at their unique features, the languages they support, and the pricing models on offer.

How do business expense tracker apps work?

Small business expense tracker apps enable businesses to track and manage their expenses with an all-in-one solution. The core capabilities include:

- Setting up a company budget

- Offering spending pattern insights

- Providing business finance forecasts

- Creating invoices and accepting payments

- Scanning receipts and reimbursing employee expenses

- Organizing due dates of incoming and outgoing payments

These apps ease the process of tracking incoming revenue sources, fixed costs, variable expenses, one-time purchases, and reimbursing employees. Users can add the business bank account, along with employees’ bank details, to speed up the expense management process.

Does my company need expense tracker software?

Managing expenses on paper or spreadsheets isn’t the wisest solution—especially if you’re looking to scale your team. Plus, a lot of difficulties can pop up with excel sheets — such as data entry errors, limited automation options, and increased manual effort.

If you’re encountering any of these issues in your day-to-day business expenditure tracking, expense tracking apps might be a great option for you. Look for these signs and you’ll know it’s time to invest in an expense management solution.

- Growing expenses: company expenses grow with the business—keeping on top of your expenditure is essential. Businesses drowning in a sea of paperwork should automate expense tracking and management.

- Inability to track financial data: this is another tell-tale sign that you might need expense tracking software. Businesses unable to make informed decisions from existing finance management processes should consider adopting automated solutions.

- Delayed reimbursements: handling reimbursements manually reduces productivity and impacts employee satisfaction. If you’re spending more than a couple of hours every month verifying and reimbursing account payables, it’s time to upgrade.

- Difficulties with regulation compliance: if you’re struggling with compliance, an expense tracking system can help you to simplify and cut through continuous compliance and risk complexity.

Not sure about the features that your expense tracker should have? We’ve compiled the essential business expense tracker features that come in handy as you grow.

What to look for in a business expense tracker app for a small business?

Small business expense tracking apps help business owners to reduce the paper trail, streamline expense entry, track tax deductions, and manage finances more efficiently.

Today’s cutting-edge expense tracking software solutions come with various features, but what exactly should you be looking for?

Here are the recommended features to look out for while choosing an expense tracking app:

- User-friendly: evaluate how easily you can learn and use the app interface and functionalities.

- Availability: check whether the app is available on Android, iOS, and desktop.

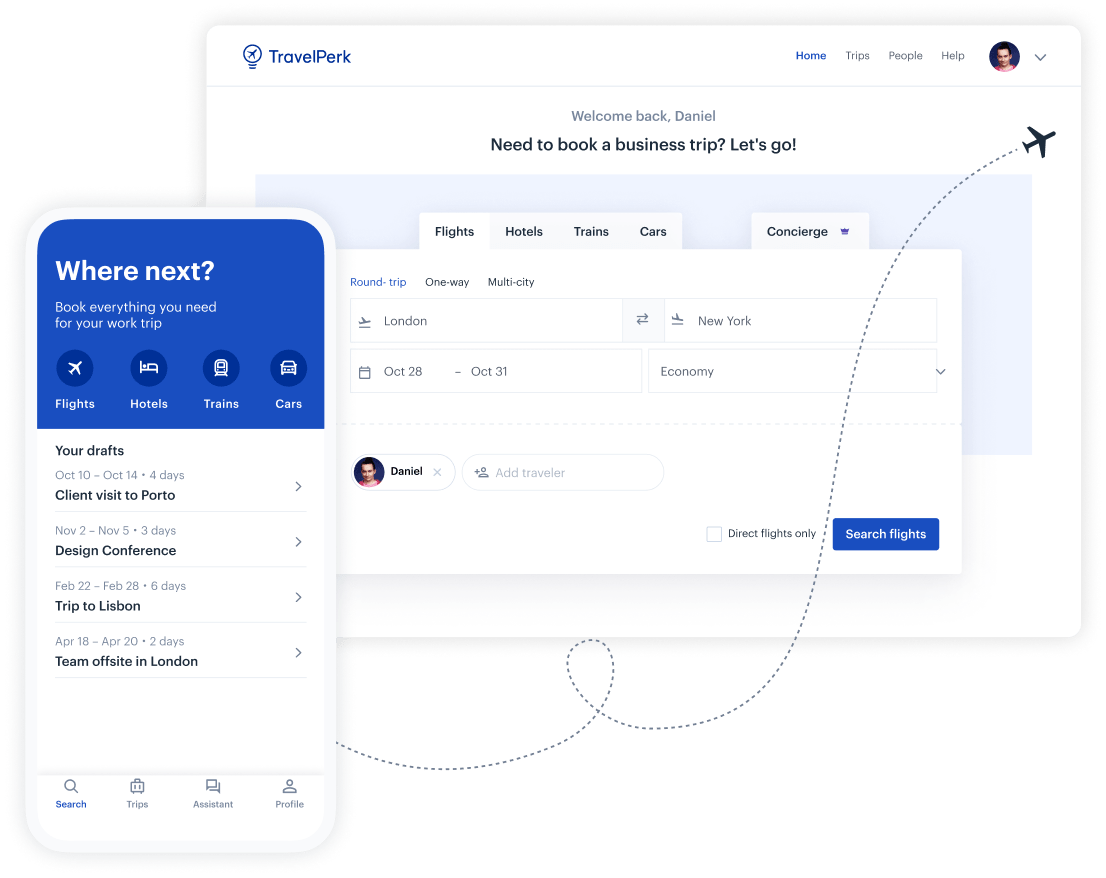

- Integrations: assess if an app allows integration with third-party apps that you regularly use. For example, if using a modern travel management tool—like TravelPerk—you want something that can integrate seamlessly to provide deeper travel spending insights.

- Scalability: consider how the vendor can help you meet future requirements.

Expense management automation and app integration are a key consideration for small businesses. Overall, you’re looking for a solution that will help you easily claim tax deductions, file IRS returns, and manage company finances seamlessly.

A good expense tracker is easy to use, tracks invoices, reimburses employees, keeps finance data ready for tax season, and is available on the go. The key to choosing an expense tracker lies in evaluating organizational needs and how well an app can perform those tasks regularly.

7 best expense trackers for small businesses

Let’s take a look at the seven best solutions to help your business simplify expense management.

1. Ramp

Ramp is a business credit card and spend management platform aimed at helping small businesses streamline automation and reduce business spending. This 5-in-1 spend management software saves precious time by taking care of corporate cards, expense management, bill payments, accounting, and reporting.

Not only can you automate expense tracking, but you can also manage bookkeeping faster with automated reconciliation. Businesses can integrate Ramp with more than 100 apps, including Slack, Okta, Xero, Google, Oracle NetSuite, QuickBooks, and Sage Intacct.

Ramp’s standout features include:

- Corporate cards: Ramp enables businesses to hold virtual cards and branded physical cards for employee and travel expenses.

- Expense management: Ramp’s expense management feature enables you to control spending with customizable restrictions. You can also leverage AI-powered receipt and digital expense policy matching to reimburse employees in one click.

- Bill payments: AI-powered invoice processing is yet another great feature that you can use to automate accounts payable and multi-level approval processes.

- Accounting automation: besides real-time transition sync for an up-to-date overview, Ramp offers direct integrations for faster accounting.

- Real-time reporting: gives you saving opportunities with AI-powered recommendations to reduce out-of-policy spending.

Supported languages: English

Cost: Free

See how Ramp integrates with TravelPerk to streamline your business trips.

2. Rydoo

Rydoo improves finance forecasting and analysis while avoiding expense management headaches of your finance team. This small business finance management tool helps you centralize employee receipts, track mileage expenses, and keep track of per diems.

You’ll be able to improve compliance, shorten reimbursement cycles, and ensure a predictable cash flow.

Rydoo’s standout features include:

- Expense claims processing: Rydoo reduces spend approval workload with out-of-policy expense warning and expense approval automation.

- Key insights: find bottlenecks, forecast expenses, and identify cost-saving opportunities with pre-designed employee and project dashboards.

- Local compliance: minimize your manual workload by setting default jurisdiction rates or custom daily allowance rates.

- Mileage tracking: Rydoo’s integrated map service allows employees to create trips and manage mileages in real-time.

- Easy scan technology: Rydoo converts employee receipts into searchable and usable key data in no time, making it easier for you to find anomalies.

- Line by line expensing: avoid end-of-the-month panics with line by line expense reports that you instantly approve.

Supported languages: English, Dutch, French, German, Portuguese, Spanish, Italian, Danish, Czech, Polish, Slovak, Hungarian, Swedish, Finnish, Chinese (simplified), and Japanese.

Cost: Essentials (€8 per user per month), Pro (€10 per user per month), and Enterprise (pricing available on request).

3. Circula

Circula is an intelligent employee finance platform that helps you manage employee expenses and corporate benefits. This app is designed to offer an intuitive user experience while helping your small business stay compliant and reduce process costs.

Circula’s AI solutions are super helpful for expense management and policy automation. You can also integrate with ERP systems, travel booking platforms like TravelPerk, and HR and payroll solutions.

Circula’s standout features include:

- Expense management: reduce admin work with Circula’s tax-optimized, and mobile-friendly receipt control solution and payroll integrations.

- Corporate credit cards: create and manage physical and virtual credit cards for employees, and control spending with a pre-set budget.

- Employee benefits: reward employees with a tax-optimized suite of benefits including digital meal vouchers, a mobility budget, and on-the-go resources.

- Lunch benefits: Increase employee engagement with the simple, cost-effective, and easy-to-set-up Circula Lunch.

Supported languages: English, Czech, Slovak, and Deutsch.

Cost: Basic (€85 for 10 users), Professional (€130 for 10 users), and Enterprise (price available on request).

4. Divvy

Divvy is a free, all-in-one expense management solution that helps you manage both business purchases and spending.

Divvy’s account payable automation simplifies payment approval and two-way data sync. Divvy also protects your business finance data with industry-leading standards such as PCI DSS and SOC2 Type 1.

Divvy’s standout features include:

- Virtual cards: manage subscriptions and make online purchases with unique cards. Divvy makes business spending easier with burner cards for one-time use and subscription cards for recurring payments.

- Reimbursements: Divvy’s painless reimbursement management process equips small businesses to tackle one-off expenses and mileage reimbursements efficiently.

- Rewards: earn weekly, semi-monthly, and monthly rewards when you make payments often using Divvy.

- Credit builder: Divvy’s credit builder program is ideal for businesses looking to obtain a credit line with an easy online application.

- Integrations: Divvy offers flexible integrations with popular software solutions such as QuickBooks and Oracle NetSuite.

- Reporting: get granular spending details and analysis, and forecast future expenditure with in-depth reporting from Divvy.

- Payments: streamline the payable process with Divvy’s free vendor payment solution that helps you save manual efforts and pay vendors on time.

Supported languages: English

Cost: Free

5. Payhawk

Payhawk is an all-in-one financial software that helps you automate and manage banking and accounting needs. From expense management to bill payment to accounting automation, Payhawk offers everything for businesses of all sizes.

You can also integrate it with many ERP systems, including Oracle NetSuite, Xero, QuickBooks, Microsoft Dynamics, Sage, Exact, and Datev.

Payhawk’s standout features include:

- Bill payments: save precious time with payment automation, thanks to Payhawk’s dedicated IBANs.

- Reimbursements: improve employee experience with one-click approvals and reimbursements.

- Invoice management: digitize invoice data extraction and reconciliation with a powerful combination of optical character recognition and machine learning.

- Visa cards: get physical and virtual Visa commercial cards for making business payments.

Supported languages: English, Spanish, and German.

Cost: Premium cards (€149 per month + €9 per month per card), All-in-one-spend solution(€299 per month + €9 per month per card), and Enterprise Suite (price available on request).

See how Payhawk integrates with TravelPerk to streamline business travel.

6. Expensify

Expensify is an expense tracking tool that comes with a range of free features, including expense tracking, invoicing, payments, travel booking, and corporate cards.

Expensify’s unique one-click receipt and expense tracking feature has helped it earn popularity among businesses of all sizes—from self-employed freelancers to Fortune 500 companies. Tracking business expenses has never looked so easy.

Expensify’s standout features include:

- One-click receipt scanner: thanks to SmartScan, you can submit a reimbursement requirement with a photo of your receipt.

- Credit card import: merge and identify personal expenses and business card transactions at ease.

- Multi-level approval workflows: meet fast-paced business needs and shorten employee reimbursement time with custom expense policy rules.

- Advanced tax tracking: create expense policies with custom tax codes, names, and rates for syncing tax rates with your accounting package.

- Audit and compliance: automate policy reinforcement with checks for transaction validity, exchange rate accuracy, and duplicate receipts.

- Delegated access: offer review-only access to auditors and allow managers to approve expense reports on a company’s behalf with varying options for access.

Supported languages: English

Cost: Free ($0), Collect ($5 per user per month with Expensify card), and Control ($9 per user per month with Expensify card).

7. Emburse: Captio

Emburse is a unified accounting software that helps modern businesses optimize and categorize every type of spend. Emburse specializes in invoice and payment solutions, as well as expense management and travel processes.

Emburse is trusted by over 16,000 organizations to date, and helps busy teams ensure compliance, eliminate those time-consuming manual tasks, and deliver usable spend insights. G2 even crowned Emburse as one of its top 50 best products for finance.

Emburse’s standout features include:

- Expense management: and AP solutions for complex enterprises to make things simpler.

- Detect & Audit: human audits utilizing tech to help identify fraud, and ensure travel booking compliance.

- Spend control: virtual and physical cards to empower your team to spend within budget—every time.

- Advanced analytics: to empower your finance teams to make data-backed decisions on business travel spend.

Supported languages: English

Cost: Starter ($9 per user per month), Professional and Enterprise plans (custom quotes).

See how Emburse integrates with TravelPerk to modernize your business travel program.

Wrapping up on the best business expenses tracking apps

A fragmented expense management process is a job half done, and—say it with us—a job half done is as good as none.

As a small business, your goal is to simplify expense tracking while unlocking insights and improving processes. The best business expense tracker will help you to create custom policies, manage reimbursement approvals on the go, and make sound financial decisions.

Expense tracking shouldn’t be a mystery—these tools make sure you’re never left in the dark and can pick the tool that’s right for your business and where you want to take it.