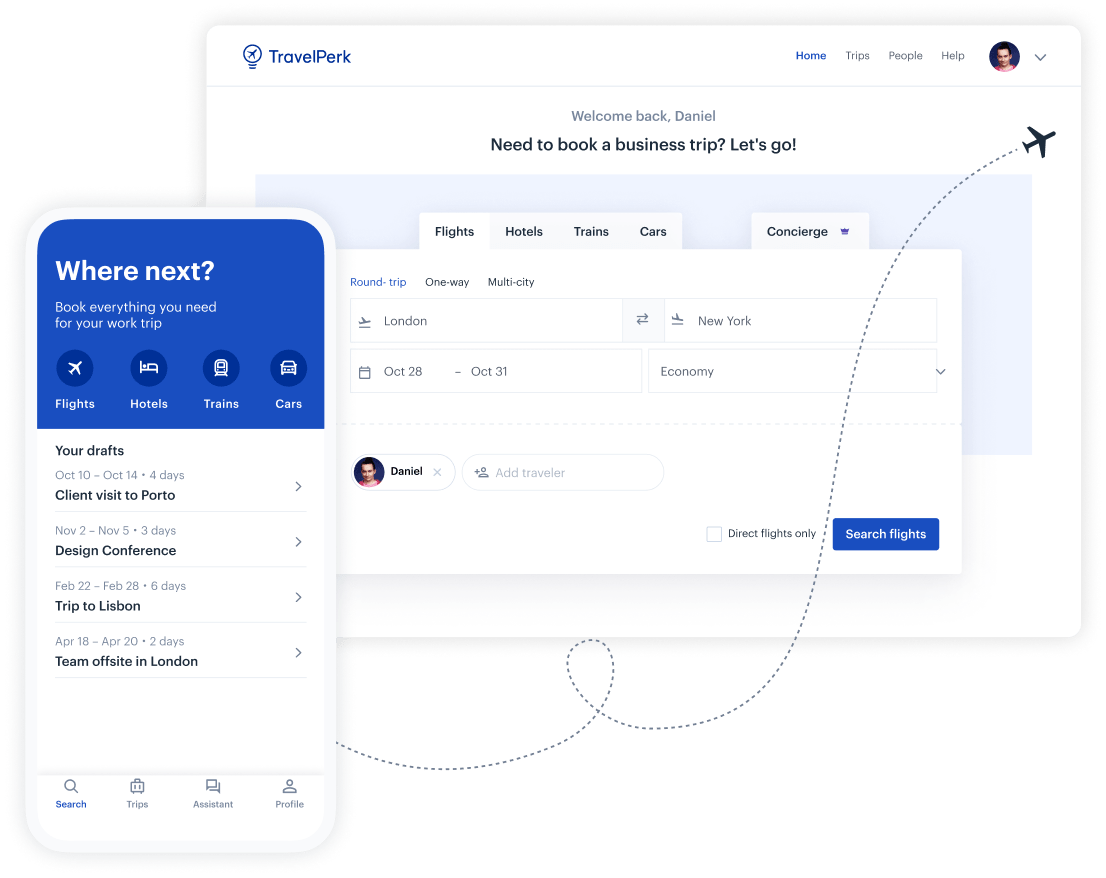

Now that you know everything there is to know about per diem allowances, it’s time to share this knowledge with your employees. A corporate travel policy that includes information on per diem payments is key to keeping your employees in the loop and in line with travel budgets.

Keeping all your travel information in one place takes the hassle out of business travel and lets your employees know they’re covered when travelling on business. It’s a handy all-in-one tool that addresses any business-related travel questions your employees might have, from allowances to per diem reimbursement.

First, let’s quickly recap the key aspects of per diem allowances.

Per diem allowances for travelling employees: a recap

Per diem payments are daily allowances given to employees to cover costs associated with business travel and trips. The allowances and methods of determining per diem allowances vary in different countries, and alternative arrangements can be arranged in some cases.

In Canada, the rates are set by the CRA. They cover meal and incidental expenses, as well as accommodation expenses for both commercial and private accommodation. There are thresholds in place for domestic and international travel expenses, with separate cost breakdowns for each country. Businesses are sometimes required to provide receipts.

The main benefit of per diem allowances is they aren't considered as taxable income. They’re also beneficial because they offer your employee flexibility in how they spend their travel allowances. Per diem payments are also less hassle than reimbursing actual expenses, as the latter requires expense reports and receipts for proof of per diem expenses.

The potential downsides to per diem payments are that they can push employees to cut corners and then pocket any excess. The same trust offered as a benefit can ultimately be abused.

Corporate travel policy for per diem payments

Corporate travel policies are useful for business travellers as they’re an easy way to check allowances while on a business trip. They should provide all the key information for employees, so they can follow corporate guidelines and avoid mistakes.

A corporate travel policy that’s well put together includes information on the company’s per diem policy so that it’s crystal clear to employees. It should provide details on:

- Reimbursable/non-reimbursable business expenses

- Reimbursement method (if not using a corporate credit card)

- International travel policy

Check out our full guide on creating a sample travel policy for employees.

It’s also important to ensure your employees aren’t at risk when travelling, and part of this is establishing a corporate travel risk management policy. Here are some key categories to consider when putting a travel risk management policy together:

1. Introduction

The document should start by outlining the policy’s aims and objectives and the company’s commitment to ensuring employees travelling on business are safe when doing so.

2. Roles and responsibilities

This section outlines the key emergency contact persons when it comes to travel risk management. It should inform all parties of their roles within the process and remind everyone of their responsibilities while away on travel.

3. Travel status and approval

This section details the proposed travel itinerary approval flow that needs to be obtained before travelling. This should list potential risks faced by the travelling employee and a clear plan as to how to minimize those risks beforehand.

These include location-based risks, such as the standard risk associated with travelling to a specific location, and individual-based risks, depending on the profile of the individual who’s travelling.

4. Incident reporting

The policy must address the employer’s responsibilities and limitations when it comes to assisting employees who are travelling for business purposes. In the event that an employee does encounter an issue while away, the steps for how to report the issue must be clearly defined in the travel policy.

Information on how to get assistance should be clear, ideally with a telephone number or email address for quick support in case of an emergency. The policy also needs to have clear information on how to report incidents and who’s responsible for ensuring they’re followed up.

5. Insurance

Finally, the policy should address what’s covered and what isn’t. This includes the loss of personal belongings and the need for medical care while on business travel. It should be accessible to employees and easy to understand—a people-friendly approach is essential.

Wrapping Up

That’s a wrap on per diem payments for travelling employees—from domestic to international business trips. Per diem is a great way to monitor business travel expenditure and ensure that all travel expenses are tax-deductible. Per diem allowances are a key part of any corporate travel policy, whether they’re benchmark rates or bespoke rates. Keep employees informed on what they can and can’t spend money on while away on business. For help creating a comprehensive corporate travel guide, head to our full guide here, and don’t hesitate to get in touch with the TravelPerk team for any other business travel needs.